4 Least squares

4.1 Regression Fundamentals

Regression Problem

The idea of regression analysis is to approximate a univariate dependent variable Y_i (also known as the regressand or response variable) as a function of the k-variate vector of the independent variables \boldsymbol X_i (also known as regressors or predictor variables). The relationship is formulated as Y_i \approx f(\boldsymbol X_i), \quad i=1, \ldots, n, where Y_1, \ldots, Y_n is a univariate dataset for the dependent variable and \boldsymbol X_1, \ldots, \boldsymbol X_n a k-variate dataset for the regressor variables.

The goal of the least squares method is to find the regression function that minimizes the squared difference between actual and fitted values of Y_i: \min_{f(\cdot)} \sum_{i=1}^n (Y_i - f(\boldsymbol X_i))^2.

Linear Regression

If the regression function f(\boldsymbol X_i) is linear in \boldsymbol X_i, i.e., f(\boldsymbol X_i) = b_1 + b_2 X_{i2} + \ldots + b_k X_{ik} = \boldsymbol X_i'\boldsymbol b, \quad \boldsymbol b \in \mathbb R^k, the minimization problem is known as the ordinary least squares (OLS) problem. The coefficient vector has k entries: \boldsymbol b = (b_1, b_2, \ldots, b_k)'. To avoid the unrealistic constraint of the regression line passing through the origin, a constant term (intercept) is always included in \boldsymbol X_i, typically as the first regressor: \boldsymbol X_i = (1, X_{i2}, \ldots, X_{ik})'.

Despite its linear framework, linear regressions can be quite adaptable to nonlinear relationships by incorporating nonlinear transformations of the original regressors. Examples include polynomial terms (e.g., squared, cubic), interaction terms (combining different variables), and logarithmic transformations.

4.2 Ordinary least squares (OLS)

The sum of squared errors for a given coefficient vector \boldsymbol b \in \mathbb R^k is defined as S_n(\boldsymbol b) = \sum_{i=1}^n (Y_i - f(\boldsymbol X_i))^2 = \sum_{i=1}^n (Y_i - \boldsymbol X_i'\boldsymbol b)^2. It is minimized by the least squares coefficient vector \widehat{\boldsymbol \beta} = \argmin_{\boldsymbol b \in \mathbb R^k} \sum_{i=1}^n (Y_i - \boldsymbol X_i'\boldsymbol b)^2.

Least squares coefficients

If the k \times k matrix (\sum_{i=1}^n \boldsymbol X_i \boldsymbol X_i') is invertible, the solution for the ordinary least squares problem is uniquely determined by \widehat{\boldsymbol \beta} = \Big( \sum_{i=1}^n \boldsymbol X_i \boldsymbol X_i' \Big)^{-1} \sum_{i=1}^n \boldsymbol X_i Y_i.

The fitted values or predicted values are \widehat Y_i = \widehat \beta_1 + \widehat \beta_2 X_{i2} + \ldots + \widehat \beta_k X_{ik} = \boldsymbol X_i'\widehat{\boldsymbol \beta}, \quad i=1, \ldots, n. The residuals are the difference between observed and fitted values: \widehat u_i = Y_i - \widehat Y_i = Y_i - \boldsymbol X_i'\widehat{\boldsymbol \beta}, \quad i=1, \ldots, n.

4.3 Simple linear regression (k=2)

A simple linear regression is a linear regression of a dependent variable Y on a constant and a single independent variable Z. I.e., we are interested in a regression function of the form \boldsymbol X_i'\boldsymbol b = b_1 + b_2 Z_i. The regressor vector is \boldsymbol X_i = (1, Z_i)'. Let’s consider Y = \log(\text{wage}) and Z = \text{education} from the following dataset with n=20 observations:

| Person | log(Wage) | Edu | Edu^2 | Edu x log(Wage) |

|---|---|---|---|---|

| 1 | 2.56 | 18 | 324 | 46.08 |

| 2 | 2.44 | 14 | 196 | 34.16 |

| 3 | 2.32 | 14 | 196 | 32.48 |

| 4 | 2.44 | 16 | 256 | 39.04 |

| 5 | 2.22 | 16 | 256 | 35.52 |

| 6 | 2.7 | 14 | 196 | 37.8 |

| 7 | 2.46 | 16 | 256 | 39.36 |

| 8 | 2.71 | 16 | 256 | 43.36 |

| 9 | 3.18 | 18 | 324 | 57.24 |

| 10 | 2.15 | 12 | 144 | 25.8 |

| 11 | 3.24 | 18 | 324 | 58.32 |

| 12 | 2.76 | 14 | 196 | 38.64 |

| 13 | 1.64 | 12 | 144 | 19.68 |

| 14 | 3.36 | 21 | 441 | 70.56 |

| 15 | 1.86 | 14 | 196 | 26.04 |

| 16 | 2.56 | 12 | 144 | 30.72 |

| 17 | 2.22 | 13 | 169 | 28.86 |

| 18 | 2.61 | 21 | 441 | 54.81 |

| 19 | 2.54 | 12 | 144 | 30.48 |

| 20 | 2.9 | 21 | 441 | 60.9 |

| sum | 50.87 | 312 | 5044 | 809.85 |

The OLS coefficients are \begin{align*} \begin{pmatrix} \widehat \beta_1 \\ \widehat \beta_2 \end{pmatrix} &= \Big( \sum_{i=1}^n \boldsymbol X_i \boldsymbol X_i' \Big)^{-1} \sum_{i=1}^n \boldsymbol X_i Y_i \\ &= \begin{pmatrix} n & \sum_{i=1}^n Z_i \\ \sum_{i=1}^n Z_i & \sum_{i=1}^n Z_i^2 \end{pmatrix}^{-1} \begin{pmatrix} \sum_{i=1}^n Y_i \\ \sum_{i=1}^n Z_i Y_i \end{pmatrix} \end{align*}

Evaluate sums: \begin{align*} \sum_{i=1}^n \boldsymbol X_i Y_i = \begin{pmatrix} 50.87 \\ 809.85 \end{pmatrix}, \quad \sum_{i=1}^n \boldsymbol X_i \boldsymbol X_i' = \begin{pmatrix} 20 & 312 \\ 312 & 5044 \end{pmatrix} \end{align*}

OLS coefficients: \begin{align*} \widehat{\boldsymbol \beta} = \begin{pmatrix} \widehat \beta_1 \\ \widehat \beta_2 \end{pmatrix} &= \begin{pmatrix} 20 & 312 \\ 312 & 5044 \end{pmatrix}^{-1} \begin{pmatrix} 50.87 \\ 809.85 \end{pmatrix} = \begin{pmatrix} 1.107 \\ 0.092 \end{pmatrix} \end{align*}

The fitted regression line is 1.107 + 0.092 \ \text{education}

There is another, simpler formula for \widehat \beta_1 and \widehat \beta_2 in the simple linear regression. It can be expressed in terms of sample means and covariances:

Simple linear regression

The least squares coefficients in a simple linear regression can be written as \widehat \beta_2 = \frac{\widehat \sigma_{YZ}}{\widehat \sigma_Z^2}, \quad \widehat \beta_1 = \overline Y - \widehat \beta_2 \overline Z, \tag{4.1} where \widehat \sigma_{YZ} is the sample covariance between Y and Z, and \widehat \sigma_Z^2 is the sample variance of Z.

4.4 Regression Plots

Line Fitting

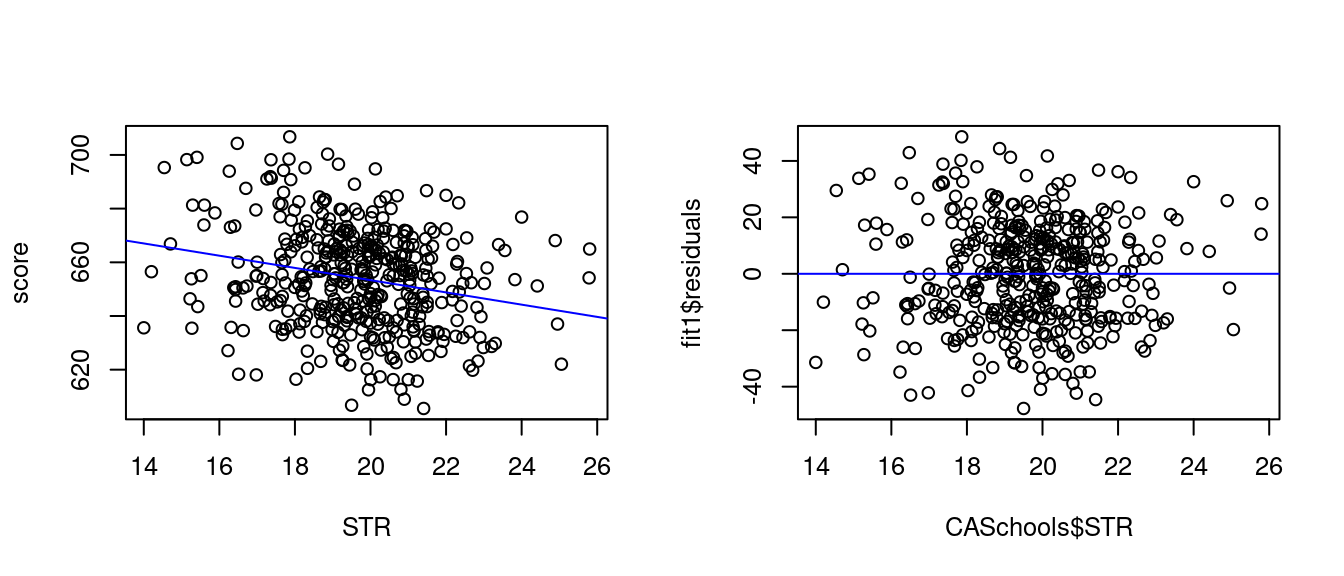

Let’s examine the linear relationship between average test scores and the student-teacher ratio:

data(CASchools, package = "AER")

CASchools$STR = CASchools$students/CASchools$teachers

CASchools$score = (CASchools$read+CASchools$math)/2

fit1 = lm(score ~ STR, data = CASchools)

fit1$coefficients(Intercept) STR

698.932949 -2.279808 We have \widehat{\boldsymbol \beta} = \begin{pmatrix} 698.9 \\ -2.28 \end{pmatrix}.

The fitted regression line is 698.9 - 2.28 \ \text{STR}. We can plot the regression line over a scatter plot of the data:

Multidimensional Visualizations

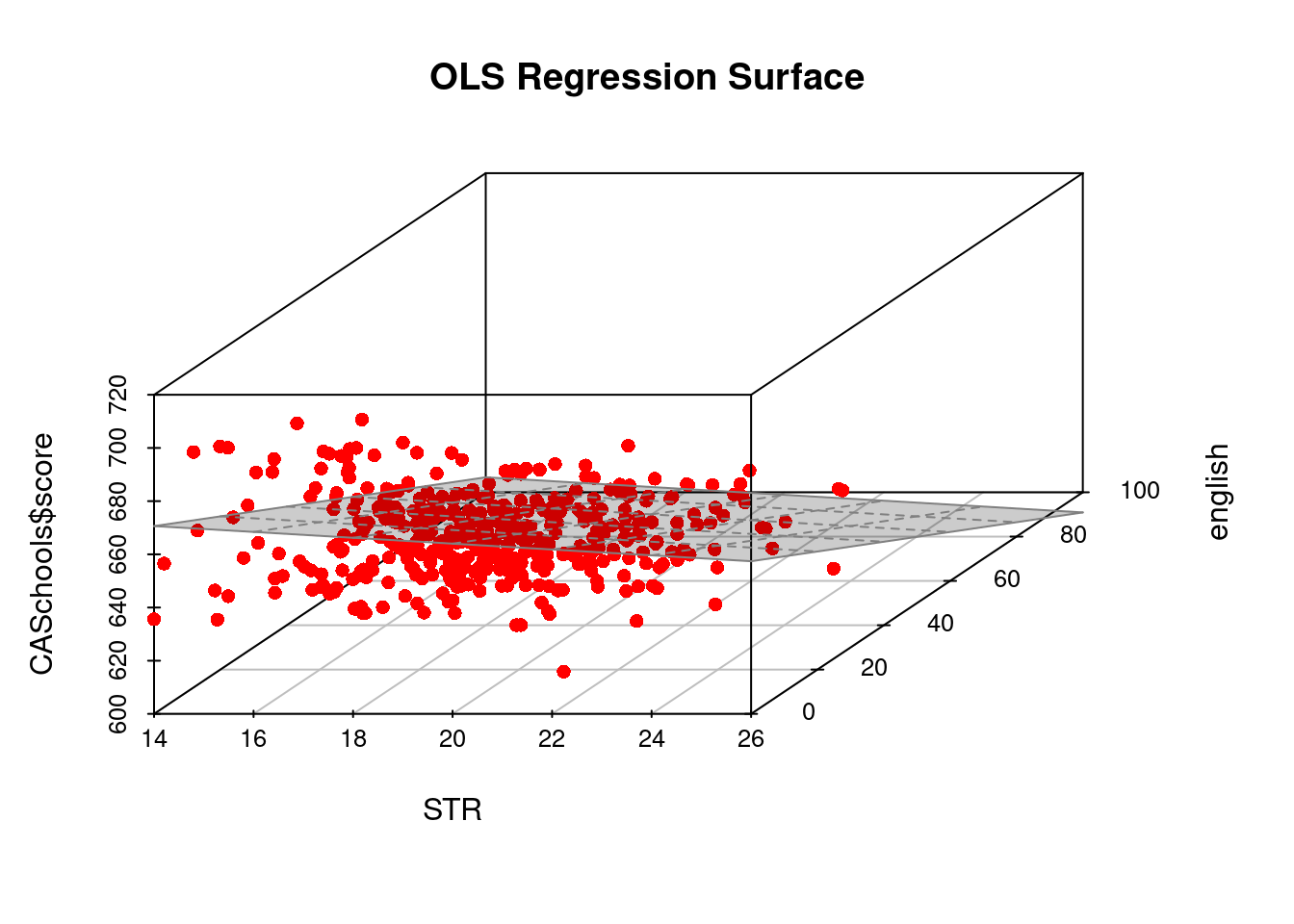

Let’s include the percentage of english learners as an additional regressor:

fit2= lm(score ~ STR + english, data = CASchools)

fit2$coefficients(Intercept) STR english

686.0322445 -1.1012956 -0.6497768 A 3D plot provides a visual representation of the resulting regression line (surface):

Adding the additional predictor income gives a regression specification with dimensions beyond visual representation:

fit3 = lm(score ~ STR + english + income, data = CASchools)

fit3$coefficients (Intercept) STR english income

640.31549821 -0.06877542 -0.48826683 1.49451661 The fitted regression line now includes three predictors and four coefficients: 640.3 - 0.07 \ \text{STR} - 0.49 \ \text{english} + 1.49 \ \text{income}

4.5 Matrix notation

OLS Formula

Matrix notation is convenient because it eliminates the need for summation symbols and indices. We define the response vector \boldsymbol Y and the regressor matrix (design matrix) \boldsymbol X as follows: \boldsymbol Y = \begin{pmatrix} Y_1 \\ Y_2 \\ \vdots \\ Y_n \end{pmatrix}, \quad \boldsymbol X = \begin{pmatrix} \boldsymbol X_1' \\ \boldsymbol X_2' \\ \vdots \\ \boldsymbol X_n' \end{pmatrix} = \begin{pmatrix} 1 & X_{12} & \ldots & X_{1k} \\ \vdots & & & \vdots \\ 1 & X_{n2} &\ldots & X_{nk} \end{pmatrix} Note that \sum_{i=1}^n \boldsymbol X_i \boldsymbol X_i' = \boldsymbol X'\boldsymbol X and \sum_{i=1}^n \boldsymbol X_i Y_i = \boldsymbol X' \boldsymbol Y.

The least squares coefficient vector becomes \widehat{\boldsymbol \beta} = \Big( \sum_{i=1}^n \boldsymbol X_i \boldsymbol X_i' \Big)^{-1} \sum_{i=1}^n \boldsymbol X_i Y_i = (\boldsymbol X'\boldsymbol X)^{-1} \boldsymbol X'\boldsymbol Y.

The vector of fitted values can be computed as follows: \widehat{\boldsymbol Y} = \begin{pmatrix} \widehat Y_1 \\ \vdots \\ \widehat Y_n \end{pmatrix} = \boldsymbol X \widehat{\boldsymbol \beta} = \boldsymbol X (\boldsymbol X'\boldsymbol X)^{-1} \boldsymbol X'\boldsymbol Y.

Projection Matrix

The vector of fitted values can be computed as follows: \widehat{\boldsymbol Y} = \begin{pmatrix} \widehat Y_1 \\ \vdots \\ \widehat Y_n \end{pmatrix} = \boldsymbol X \widehat{\boldsymbol \beta} = \underbrace{\boldsymbol X (\boldsymbol X'\boldsymbol X)^{-1} \boldsymbol X'}_{=\boldsymbol P}\boldsymbol Y = \boldsymbol P \boldsymbol Y. The projection matrix \boldsymbol P is also known as the influence matrix or hat matrix and maps observed values to fitted values.

The diagonal entries of \boldsymbol P, given by h_{ii} = \boldsymbol X_i'(\boldsymbol X' \boldsymbol X)^{-1} \boldsymbol X_i, are called leverage values or hat values and measure how far away the regressor values of the i-th observation X_i are from those of the other observations.

Properties of leverage values: 0 \leq h_{ii} \leq 1, \quad \sum_{i=1}^n h_{ii} = k.

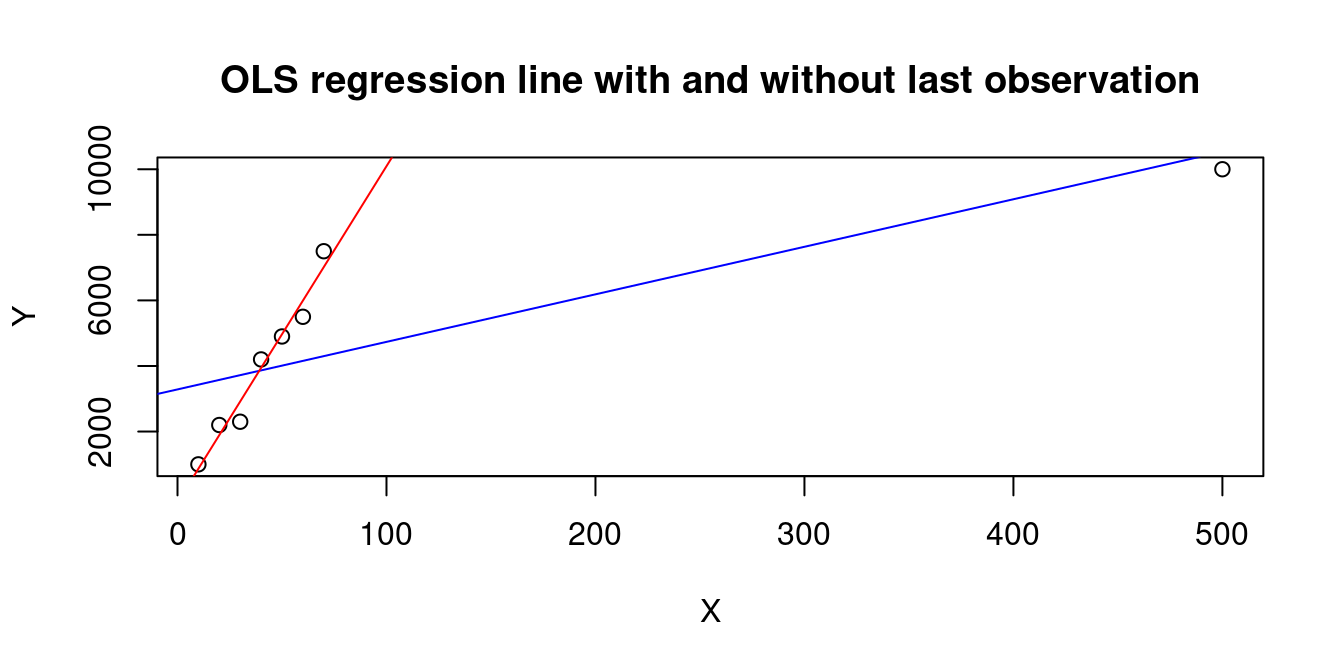

A large h_{ii} occurs when the observation i has a big influence on the regression line, e.g., the last observation in the following dataset:

X=c(10,20,30,40,50,60,70,500)

Y=c(1000,2200,2300,4200,4900,5500,7500,10000)

plot(X,Y, main="OLS regression line with and without last observation")

abline(lm(Y~X), col="blue")

abline(lm(Y[1:7]~X[1:7]), col="red")

1 2 3 4 5 6 7 8

0.1657356 0.1569566 0.1492418 0.1425911 0.1370045 0.1324820 0.1290237 0.9869646 Residuals

The vector of residuals is given by \widehat{\boldsymbol u} = \begin{pmatrix} \widehat u_1 \\ \vdots \\ \widehat u_n \end{pmatrix} = \boldsymbol Y - \widehat{\boldsymbol Y} = \boldsymbol Y - \boldsymbol X \widehat{\boldsymbol \beta}.

An important property of the residual vector is: \boldsymbol X'\widehat{\boldsymbol u} = \boldsymbol 0. To see that this property holds, let’s rearrange the OLS formula: \widehat{\boldsymbol \beta} = (\boldsymbol X'\boldsymbol X)^{-1} \boldsymbol X'\boldsymbol Y \quad \Leftrightarrow \quad \boldsymbol X'\boldsymbol X \widehat{\boldsymbol \beta} = \boldsymbol X'\boldsymbol Y. The dependent variable vector can be decomposed into the vector of fitted values and the residual vector: \boldsymbol Y = \boldsymbol X\widehat{\boldsymbol \beta} + \widehat{\boldsymbol u}. Substituting this into the OLS formula from above gives: \boldsymbol X'\boldsymbol X \widehat{\boldsymbol \beta} = \boldsymbol X' (\boldsymbol X\widehat{\boldsymbol \beta} + \widehat{\boldsymbol u}) \quad \Leftrightarrow \quad \boldsymbol 0 = \boldsymbol X'\widehat{\boldsymbol u}.

This property has a geometric interpretation: it means the residuals are orthogonal to all regressors. This makes sense because if there were any linear relationship left between the residuals and the regressors, we could have captured it in our model to improve the fit.

4.6 Goodness of Fit

Analysis of Variance

The orthogonality property of the residual vector can be written in a more detailed way as follows: \boldsymbol X' \widehat{\boldsymbol u} = \begin{pmatrix} \sum_{i=1}^n \widehat u_i \\ \sum_{i=1}^n X_{i2} \widehat u_i \\ \vdots \\ \sum_{i=1}^n X_{ik} \widehat u_i \end{pmatrix} = \begin{pmatrix} 0 \\ 0 \\ \vdots \\ 0 \end{pmatrix}. \tag{4.2} In particular, the sample mean of the residuals is zero: \frac{1}{n}\sum_{i=1}^n \widehat u_i = 0. Therefore, the sample variance of the residuals is simply the sample mean of squared residuals: \widehat \sigma_{\widehat u}^2 = \frac{1}{n} \sum_{i=1}^n \widehat u_i^2. The sample variance of the dependent variable is \widehat \sigma_Y^2 = \frac{1}{n} \sum_{i=1}^n (Y_i - \overline Y)^2, and the sample variance of the fitted values is \widehat \sigma_{\widehat Y}^2 = \frac{1}{n} \sum_{i=1}^n (\widehat Y_i - \overline{\widehat Y})^2. The three sample variances are connected through the analysis of variance formula: \widehat \sigma_Y^2 = \widehat \sigma_{\widehat Y}^2 + \widehat \sigma_{\widehat u}^2. Hence, the larger the proportion of the explained sample variance, the better the fit of the OLS regression.

R-squared

The analysis of variance formula motivates the definition of the R-squared coefficient: R^2 = 1 - \frac{\widehat \sigma_{\widehat u}^2}{\widehat \sigma_{Y}^2} = 1 - \frac{\sum_{i=1}^n \widehat u_i^2}{\sum_{i=1}^n (Y_i - \overline Y)^2} = \frac{\sum_{i=1}^n (\widehat Y_i - \overline{\widehat Y})^2}{\sum_{i=1}^n (Y_i - \overline Y)^2}.

The R-squared describes the proportion of sample variation in \boldsymbol Y explained by \widehat{\boldsymbol Y}. We have 0\leq R^2\leq 1.

In a regression of Y_i on a single regressor Z_i with intercept (simple linear regression), the R-squared is equal to the squared sample correlation coefficient of Y_i and Z_i.

An R-squared of 0 indicates no sample variation in \widehat{\boldsymbol{Y}} (a flat regression line/surface), whereas a value of 1 indicates no variation in \widehat{\boldsymbol{u}}, indicating a perfect fit. The higher the R-squared, the better the OLS regression fits the data.

However, a low R-squared does not necessarily mean the regression specification is bad. It just implies that there is a high share of unobserved heterogeneity in \boldsymbol Y that is not captured by the regressors \boldsymbol X linearly.

Conversely, a high R-squared does not necessarily mean a good regression specification. It just means that the regression fits the sample well. Too many unnecessary regressors lead to overfitting.

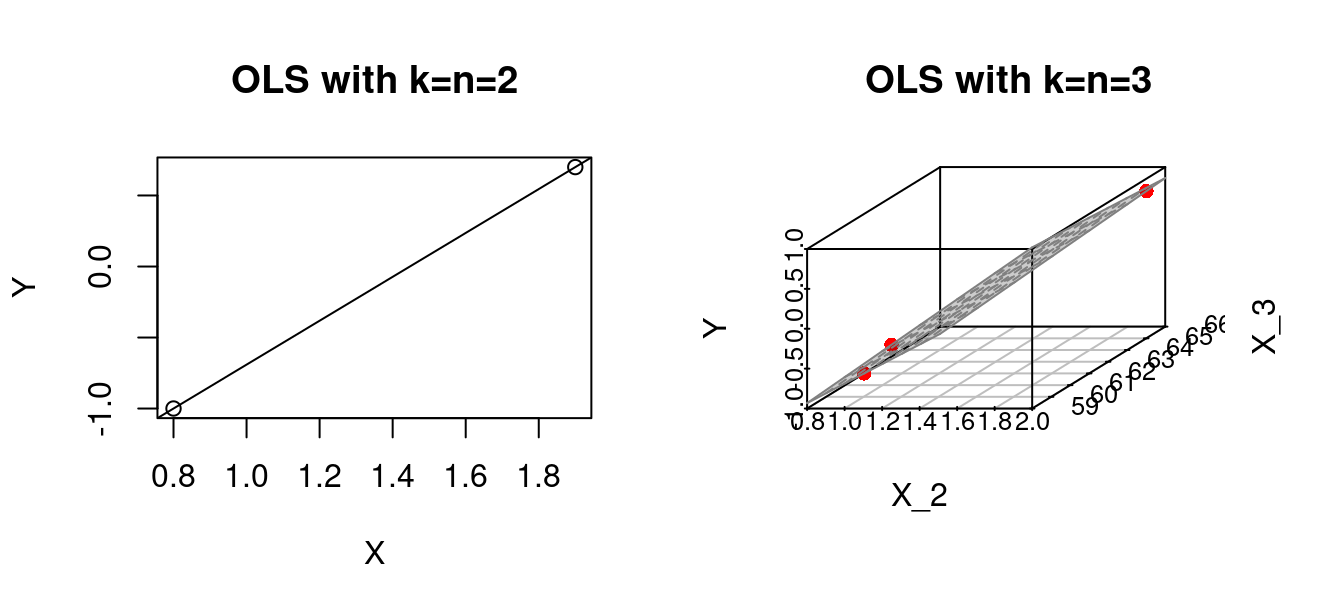

If k=n, we have R^2 = 1 even if none of the regressors has an actual influence on the dependent variable.

Degree of Freedom Corrections

Adjusted Sample Variance

When computing the sample mean \overline Y, we have n degrees of freedom because all data points Y_1, \ldots, Y_n can vary freely.

When computing variances, we take the sample mean of the squared deviations (Y_1 - \overline Y)^2, \ldots, (Y_n - \overline Y)^2. These elements cannot vary freely because \overline Y is computed from the same sample and implies the constraint \frac{1}{n} \sum_{i=1}^n (Y_i - \overline{Y}) = 0.

This means that the deviations are connected by this equation and are not all free to vary. Knowing the first n-1 of the deviations determines the last one: (Y_n - \overline Y) = - \sum_{i=1}^{n-1} (Y_i - \overline Y). Therefore, only n-1 deviations can vary freely, which results in n-1 degrees of freedom for the sample variance.

Because \sum_{i=1}^{n} (Y_i - \overline Y)^2 effectively contains only n-1 freely varying summands, it is common to account for this fact. The adjusted sample variance uses n−1 in the denominator:

s_Y^2 = \frac{1}{n-1} \sum_{i=1}^n (Y_i - \overline Y)^2.

The adjusted sample variance relates to the unadjusted sample variance as:

s_Y^2 = \frac{n}{n-1} \widehat \sigma_Y^2.

Its square root, s_Y = \sqrt{\frac{1}{n-1} \sum_{i=1}^n (Y_i - \overline Y)^2}, is the adjusted sample standard deviation. Note: the built-in R functions var(Y) and sd(Y) compute the adjusted versions of the sample variance and standard deviations.

Adjusted Residual Variance

For the sample variance of \widehat{\boldsymbol u}, we lose k degrees of freedom because the residuals are subject to the constraints from Equation 4.2. The adjusted sample variance of the residuals is therefore defined as: s_{\widehat u}^2 = \frac{1}{n-k}\sum_{i=1}^n \widehat u_i^2.

The square root of the adjusted sample variance of the residuals is called the standard error of the regression (SER) or residual standard error: SER := s_{\widehat u} = \sqrt{ \frac{1}{n-k}\sum_{i=1}^n \widehat u_i^2 }.

The square root of the unadjusted sample variance of the residuals is also called the Root Mean Squared Error (RMSE): RMSE(\widehat{\boldsymbol \beta}) = \widehat \sigma_{\widehat u} = \sqrt{\frac{1}{n} \sum_{i=1}^n \widehat u_i^2}.

Adjusted R-squared

By incorporating adjusted versions of the sample variances in the R-squared definition, we penalize regression specifications with large k. The adjusted R-squared is \overline{R}^2 = 1 - \frac{\frac{1}{n-k}\sum_{i=1}^n \widehat u_i^2}{\frac{1}{n-1}\sum_{i=1}^n (Y_i - \overline Y)^2} = 1 - \frac{s_{\widehat u}^2}{s_Y^2}.

The R-squared should be used for interpreting the share of variation explained by the fitted regression line. The adjusted R-squared should be used for comparing different OLS regression specifications.

4.7 Regression Table

The modelsummary() function can be used to produce comparison tables of regression outputs:

library(modelsummary)

mymodels = list(fit1, fit2, fit3)

modelsummary(mymodels,

statistic = NULL,

gof_map = c("nobs", "r.squared", "adj.r.squared", "rmse"))| (1) | (2) | (3) | |

|---|---|---|---|

| (Intercept) | 698.933 | 686.032 | 640.315 |

| STR | -2.280 | -1.101 | -0.069 |

| english | -0.650 | -0.488 | |

| income | 1.495 | ||

| Num.Obs. | 420 | 420 | 420 |

| R2 | 0.051 | 0.426 | 0.707 |

| R2 Adj. | 0.049 | 0.424 | 0.705 |

| RMSE | 18.54 | 14.41 | 10.30 |

Model (3) explains the most variation in test scores and provides the best fit to the data, as indicated by the highest R^2 and the lowest residual standard error.

In model (1), schools with one more student per class are predicted to have a 2.28-point lower test score. This effect decreases to 1.1 points in model (2), after accounting for the percentage of English learners, and drops further to just 0.07 points in model (3), once income is also included.

While the R-squared increases in the number of regressors, the RMSE decreases.

To give deeper meaning to these results and understand their interpretation within a broader context, we turn to a formal probabilistic model framework in the next section.

4.8 When OLS Fails

Too many regressors

OLS should be considered for regression problems with k << n (small k and large n). When the number of predictors k approaches or equals the number of observations n, we run into the problem of overfitting. Specifically, at k = n, the regression line will perfectly fit the data.

If k=n \geq 4, we can no longer visualize the OLS regression line in the 3D space, but the problem of a perfect fit is still present. If k > n, there exists no unique OLS solution because \boldsymbol X' \boldsymbol X is not invertible. Regression problems with k \approx n or k>n are called high-dimensional regressions.

Perfect multicollinearity

The only requirement for computing the OLS coefficients is the invertibility of the matrix \boldsymbol X' \boldsymbol X. As discussed above, a necessary condition is that k \leq n.

Another reason the matrix may not be invertible is if two or more regressors are perfectly collinear. Two variables are perfectly collinear if their sample correlation is 1 or -1. Multicollinearity arises if one variable is a linear combination of the other variables.

Common causes are duplicating a regressor or using the same variable in different units (e.g., GDP in both EUR and USD).

Perfect multicollinearity (or strict multicollinearity) arises if the regressor matrix does not have full column rank: \text{rank}(\boldsymbol X) < k. It implies \text{rank}(\boldsymbol X' \boldsymbol X) < k, so that the matrix is singular and \widehat{\boldsymbol \beta} cannot be computed.

Near multicollinearity occurs when two columns of \boldsymbol X have a sample correlation very close to 1 or -1. Then, (\boldsymbol X' \boldsymbol X) is “near singular”, its eigenvalues are very small, and (\boldsymbol X' \boldsymbol X)^{-1} becomes very large, causing numerical problems.

If k \leq n and multicollinearity is present, it means that at least one regressor is redundant and can be dropped.

Dummy variable trap

A common cause of strict multicollinearity is the inclusion of too many dummy variables. Let’s consider the cps data and add a dummy variable for non-married individuals:

cps = read.csv("cps.csv")

cps$nonmarried = 1-cps$married

fit4 = lm(wage ~ married + nonmarried, data = cps)

fit4$coefficients(Intercept) married nonmarried

19.305329 6.920139 NA The coefficient for nonmarried is NA. We fell into the dummy variable trap!

The dummy variables married and nonmarried are collinear with the intercept variable because married + nonmarried = 1, which leads to a singular matrix \boldsymbol X' \boldsymbol X and therefore to perfect multicollinearity.

The solution is to use one dummy variable less than factor levels, as R automatically does by omitting the last dummy variable. Another solution would be to remove the intercept from the model, which can be done by adding -1 to the model formula:

fit5 = lm(wage ~ married + nonmarried - 1, data = cps)

fit5$coefficients married nonmarried

26.22547 19.30533